Trend 1. Getting to know Gen Z

Gen Z is now attracting the type of attention that has long been bestowed on millennials, but with little separating Gen Zers (16-20) from the youngest millennials in age, how different are these two target audiences?

Do Gen Zers really have defining characteristics distinct from those of their millennial counterparts?

The simple answer here is yes. While there are plenty of common behaviors and attitudes which unite the two groups, here we outline six things about Gen Z that all marketers should have on their radar in 2018.

01. Generation Mobile

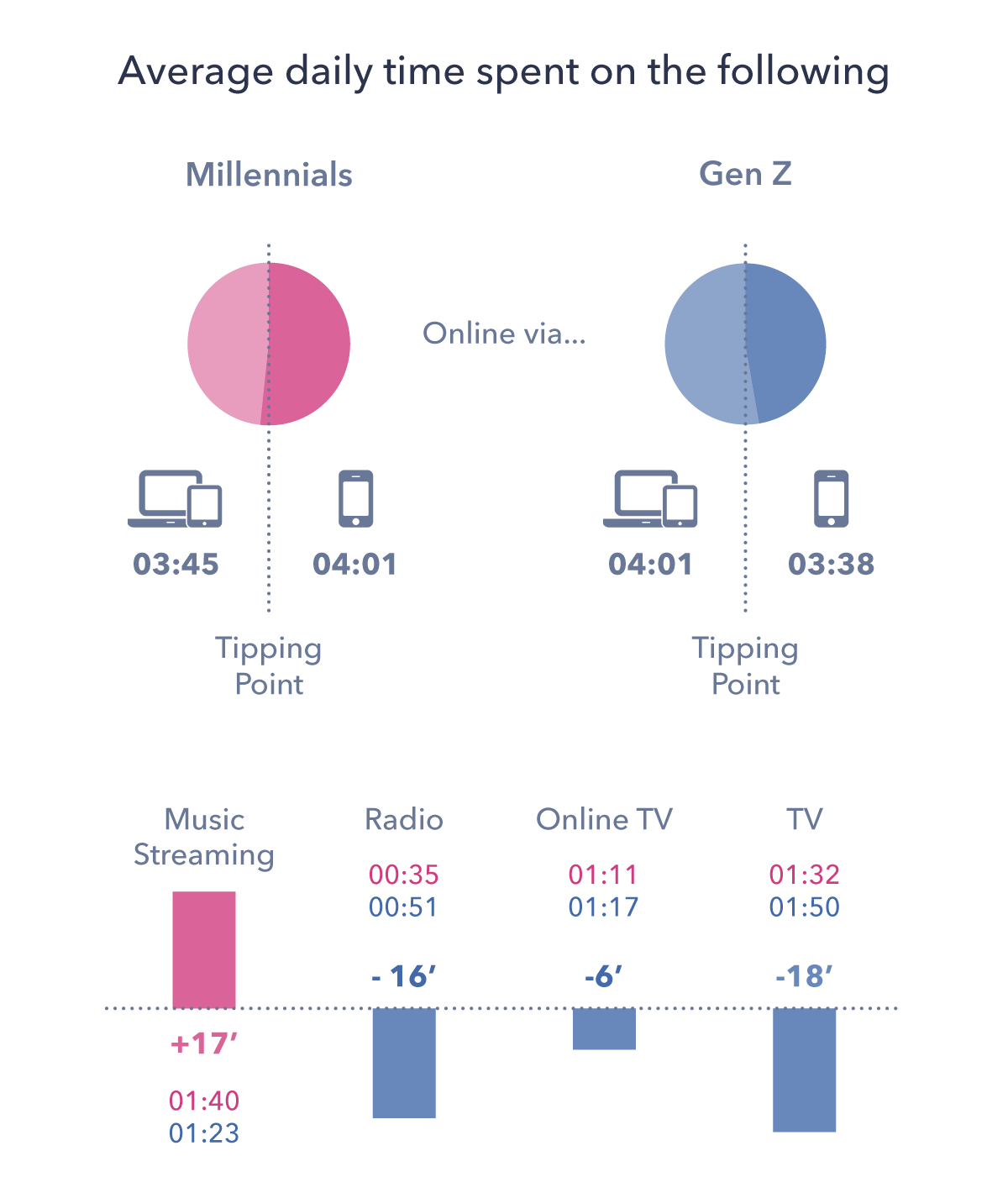

Gen Z stand apart from the equally mobile-centric millennial generation for having crossed the mobile tipping point – meaning they spend longer on their phones each day than on all other devices combined.

The mobile-first mindset of Gen Zers has a profound impact on their other media behaviors. They spend longer than millennials on music streaming (a very mobile-friendly activity) and also devote around 20 minutes less per day to broadcast TV.

Interestingly, they are also a little behind for online TV/streaming, but that’s partly because of their love of all things social and all things video – which leads to a demand for short bite-sized content.

02. Social, Social, Social

Gen Z visit about the same number of social platforms/apps as millennials – an average of 6.5 each month.

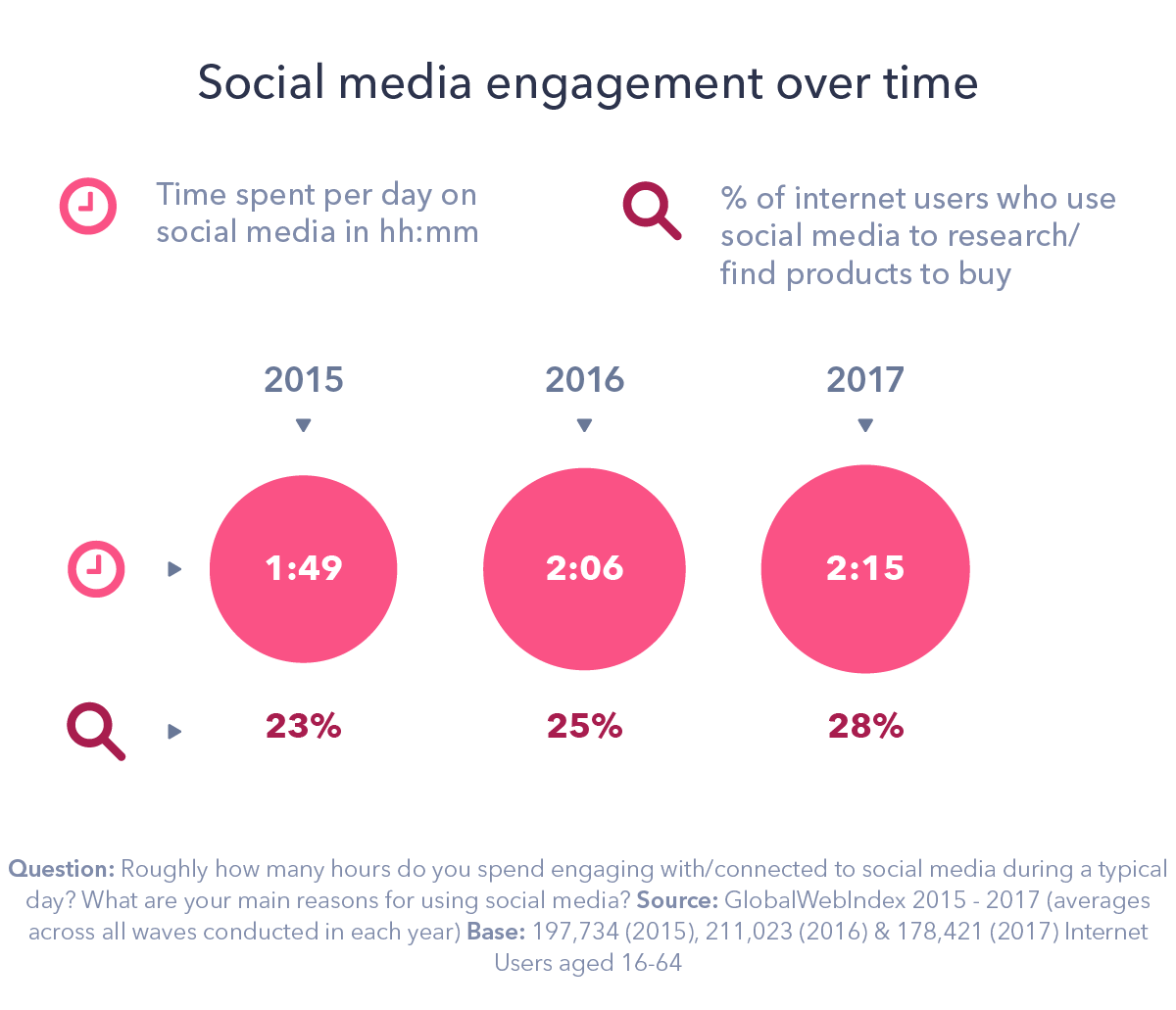

However, Gen Z devote longer each day to social media than their older counterparts, averaging nearly 3 hours (vs 2 hrs 39 mins for millennials). Their attachment to mobile is a clear contributor to this, promoting an anytime, anywhere type of social engagement.

The mobile-centric nature of Gen Z also drives their engagement with particular platforms.

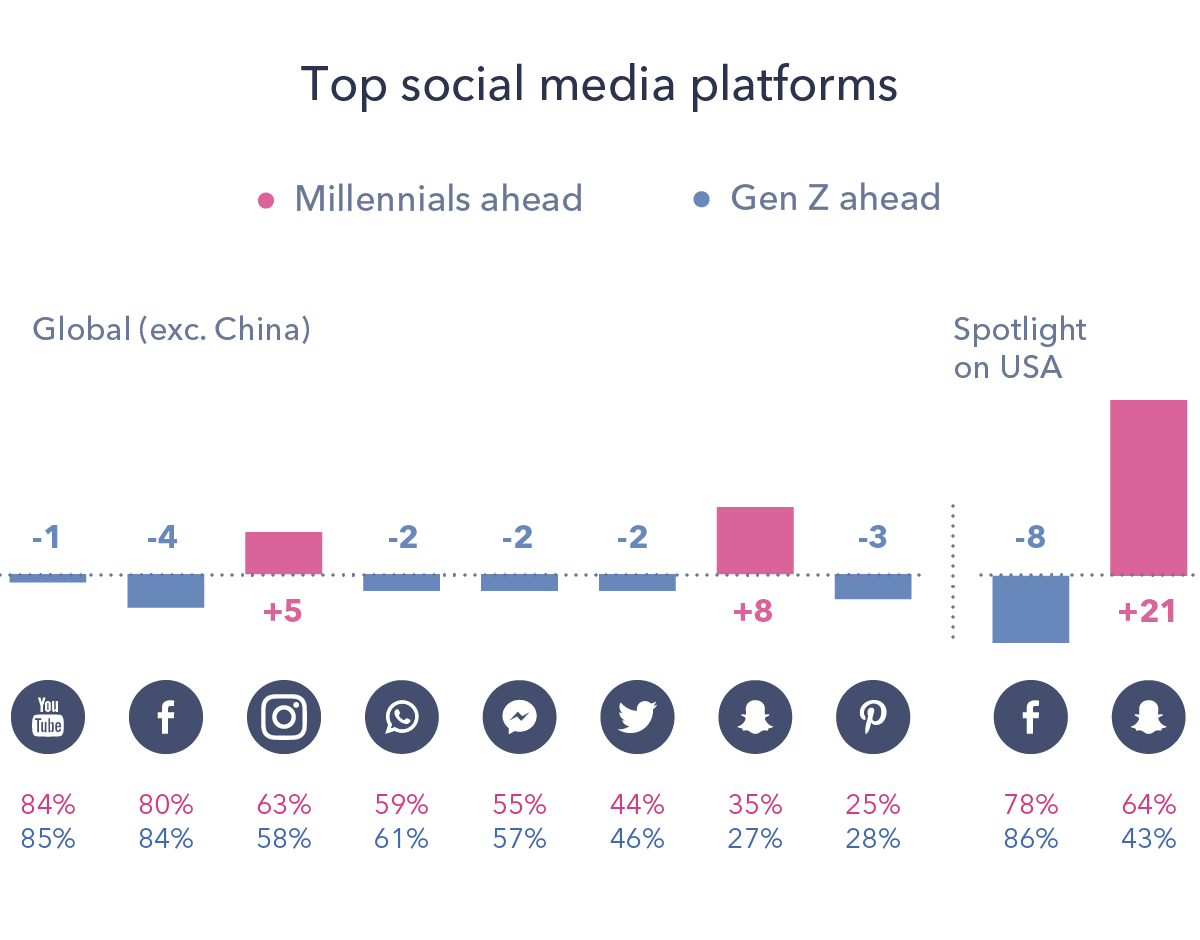

Facebook and YouTube may still attract the biggest Gen Z contingent but Gen Zers are slightly less likely than millennials to be Facebooking, Pinteresting or Tweeting, and more likely to be Instagramming and Snapchatting.

Gen Z are less likely to be Facebooking and more likely to be Snapchatting

This trend becomes particularly apparent in a key market like the US, where Gen Z have a 20-point lead over Millennials for using Evan Spiegel’s app. The appeal of these “younger” apps, as well as this audience’s fondness for photos and bite-sized content, is highly relevant too.

03. Time rich

We’ve seen already that Gen Z love social, and spend longer on it than any other generation.

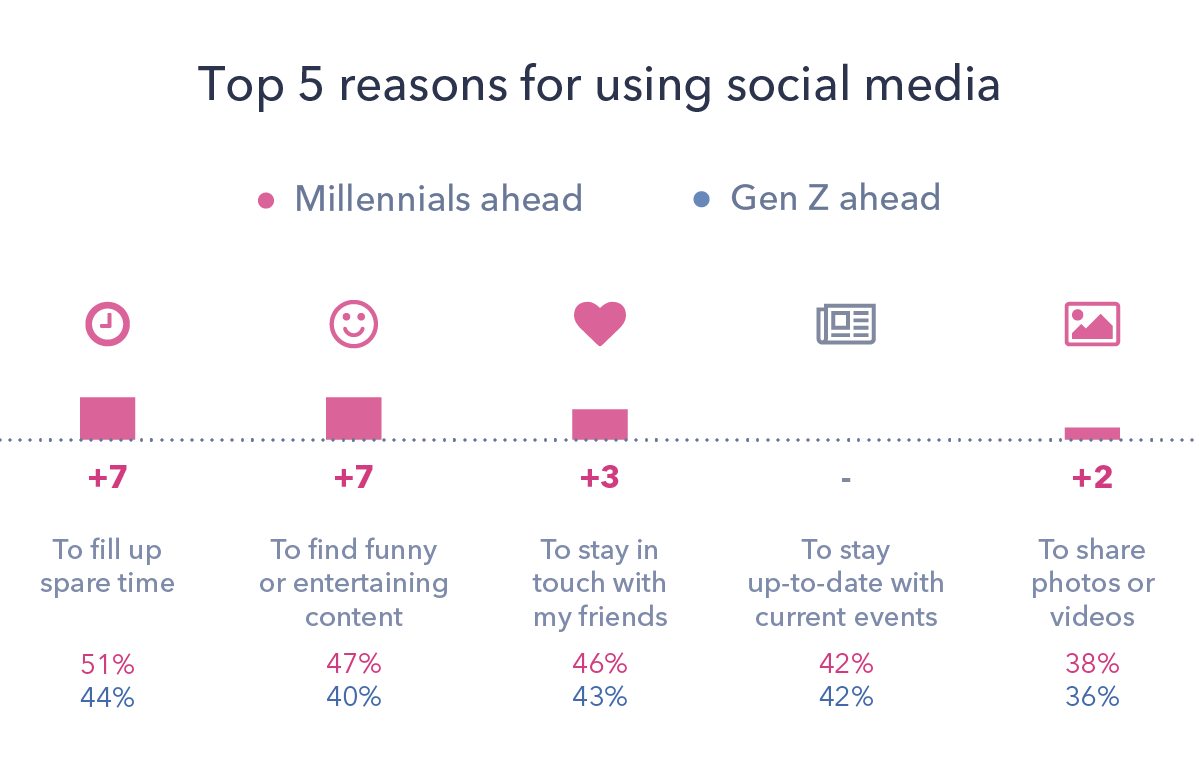

One key reason is that they use social media to fill up their spare time – much more so than millennials.

In fact, while the two generations score equal figures for the majority of the social media usage motivations we track, they stand apart not just for killing time, but for finding content.

Gen Zers want to be entertained, and they’re looking for this to happen in the social space.

04. Social Research

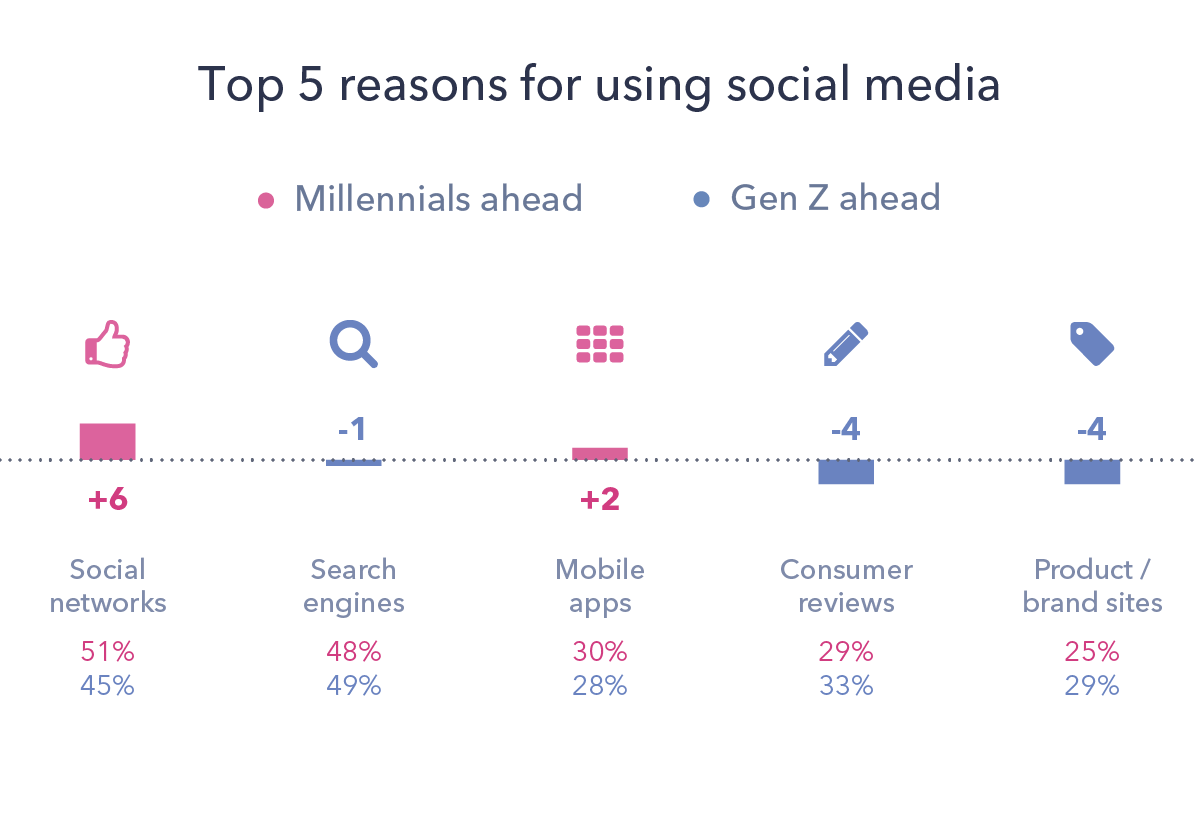

Social comes to the forefront once again for brand research. Gen Z are the only generation where more people say they use social media to research products than search engines.

What’s more, Gen Z consistently under-indexes for “traditional” channels like price comparison and consumer review sites, while over-indexing for “newer” channels such as vlogs.

Gen Z are more likely to use social media to research products than search engines

05. Status Matters

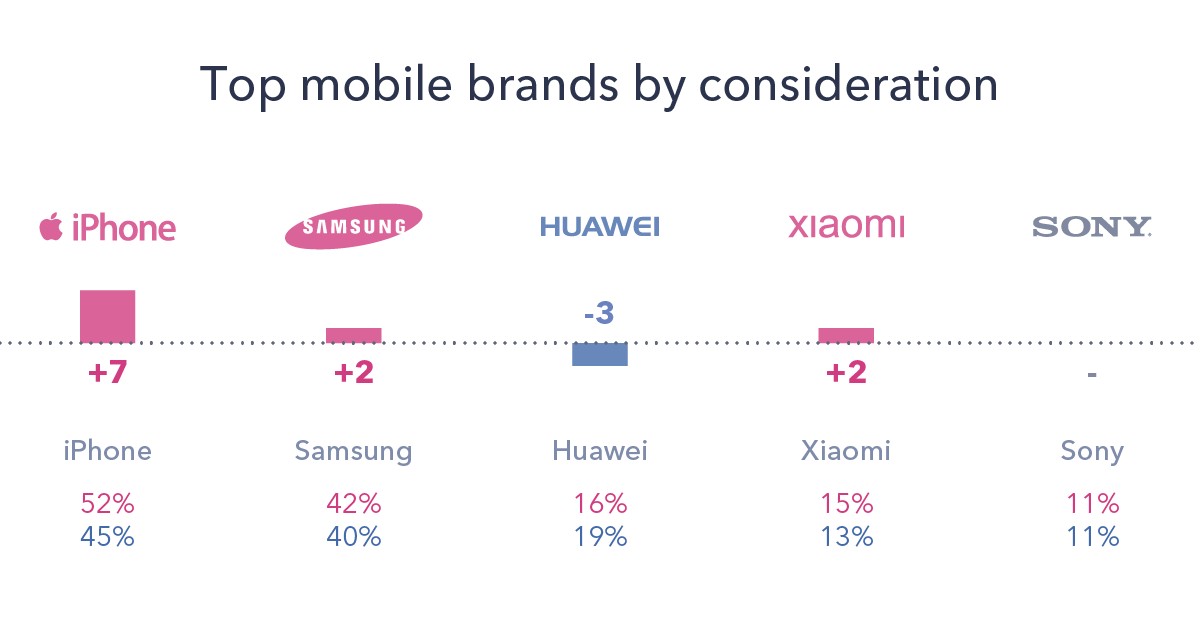

Ask Gen Z which brand(s) would be their top choice for their next mobile handset, and this generation’s love of status is clear: the iPhone is not just the top choice, it’s of bigger appeal to Gen Z than to millennials.

In some of Apple’s strongest markets, this trend becomes even more pronounced: in the UK, for example, 2 in 3 Gen Zers cite the iPhone as their most coveted handset, vs 1 in 2 Millennials.

This runs through their attitudes too:

1 in 4 Gen Z consumers want brands to make them feel cool or trendy.

This is compared to 1 in 5 millennials and 1 in 7 internet users more generally. This is a generation that wants to look and feel the part.

06. Enthusiasm Trumps Ownership

Gen Z might know what they want, but in many cases they lack the spending power to obtain it. Helping this generation to realize their aspirations is a key challenge.

So, while they over-index notably for wanting an iPhone as their next handset, they lag behind millennials for actually owning one.

In fact, across the 11 connected devices we track for personal ownership, they are less likely than millennials to have 10 of them (the smartphone being the only exception).

But even for their much-loved mobiles, Gen Zers are notably less likely to say they plan to upgrade or buy a new handset in the next 18 months.

Similarly, they are less likely than millennials to feel affluent, less likely to have bought premium brands, and more likely to value things such as free delivery and money-off coupons.

Trend 2. Social commerce: take two

It has often been assumed that social commerce will transform the way we shop online. As we enter 2018, however, it’s a trend that has gained traction in parts of Asia but is yet to take hold in the West, where online shopping is still firmly rooted in traditional online retailers.

Many major social platforms have learned the lesson that introducing ‘buy’ buttons does not automatically equate to in-platform sales.

But as 2017 draws to a close, two converging trends could lay the groundwork for social commerce to re-enter the stage: changing consumer mindsets and evolving social engagement patterns.

For commerce and social activities to take place in the same space, it needs to be on mobile

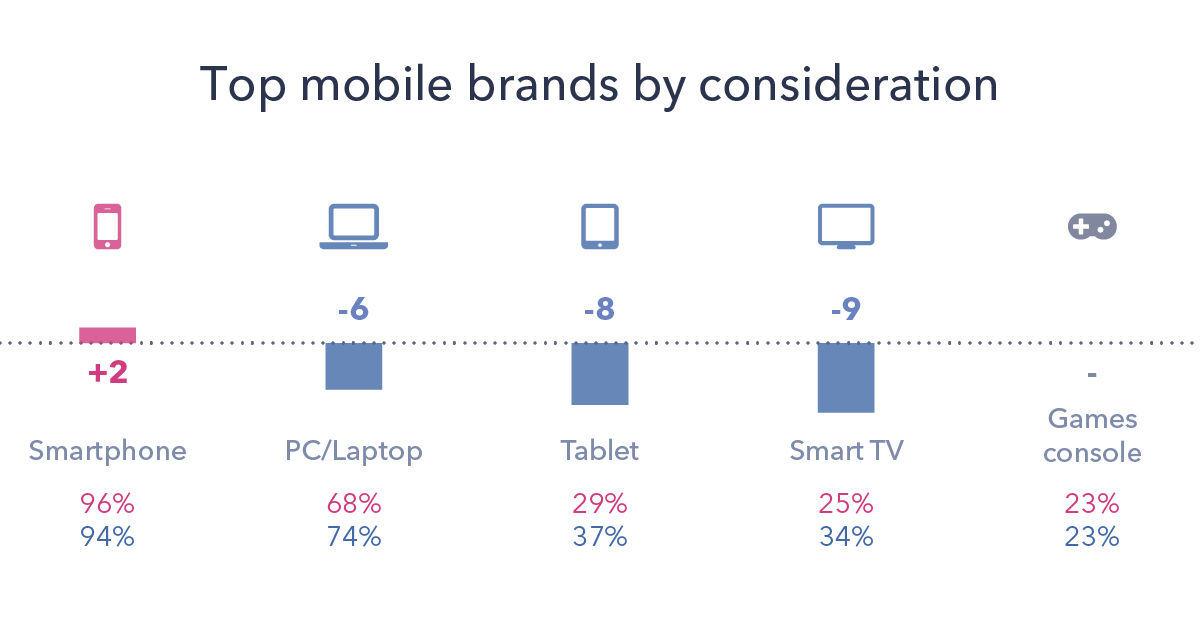

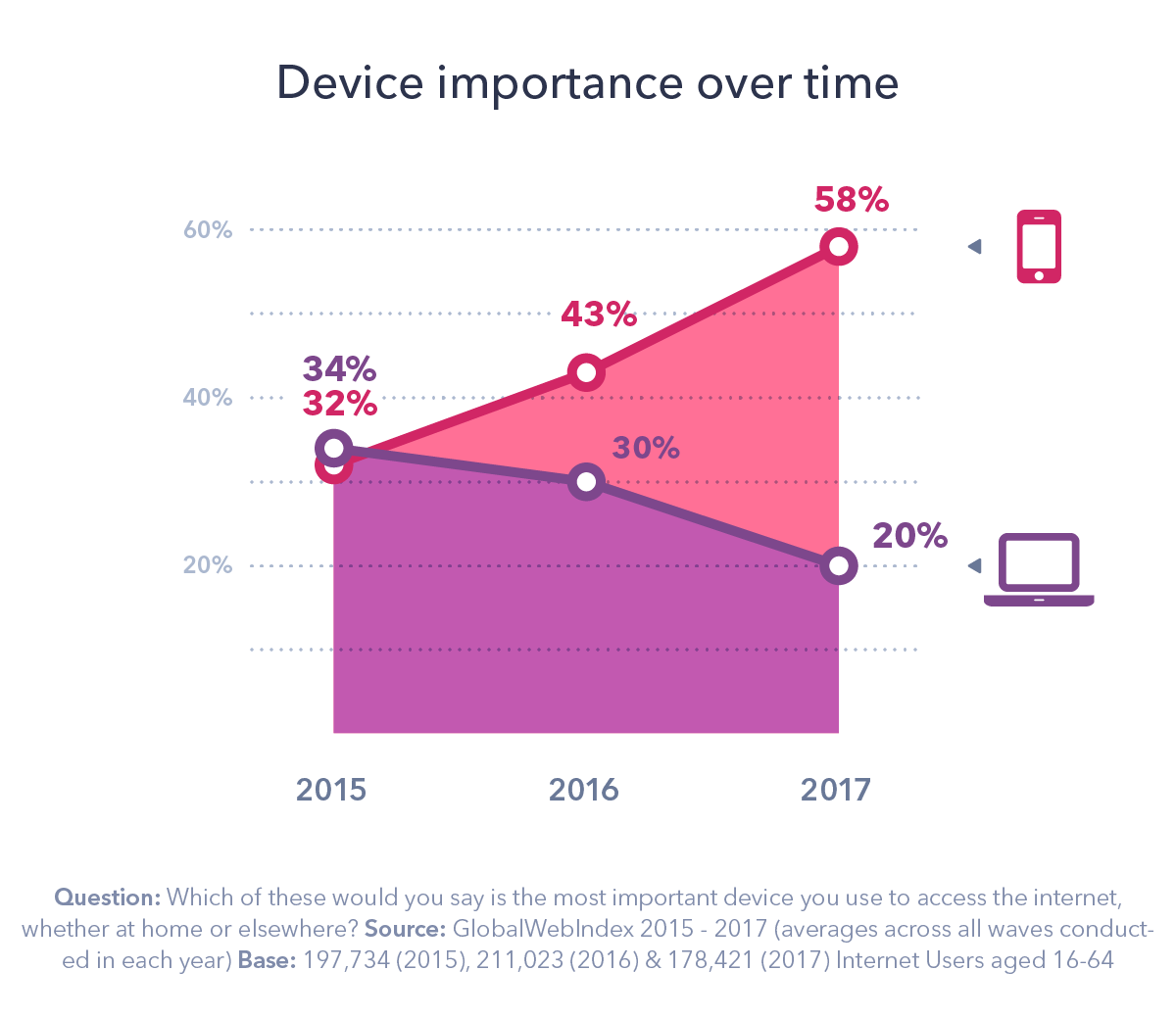

Rising smartphone ownership together with declining PC/laptop ownership are being compounded by a striking growth in consumers classing mobiles as their most important devices for getting online; globally, 58% now say this. What’s more, online buying - once a PC/laptop-centric activity due to the perceived security benefits of these devices – is now a mobile-first activity

This can only be good news for social commerce, with mobiles able to facilitate a seamless combination of transactional and social activities (just look at the success of Weixin/WeChat in China as a commerce platform).

Of course, social media engagement has long been a mobile-first activity. But the rise of the mobile as the main gateway into social has brought with it two critical trends: multi-networking and passive networking.

Maintaining a portfolio of social media accounts has resulted in many users picking and choosing between platforms for particular activities in order to engage with specific groups.

And the migration of many online activities to social has meant networkers are a lot more likely to be using social media for more purposeful reasons, especially when it comes to commerce.

Social strengthening its role as a product research channel and rising time spent on social media per day both point towards networking behaviors becoming less centered around sharing content about daily lives, and more oriented around fulfilling activities which conventionally lie outside of the social arena.

For ‘buy’ buttons to catch on, social platforms need to persuade consumers that they are a viable, secure and above all convenient way to shop.

The only way to do this is to nurture those areas where social and commerce activities currently overlap the most, such as product research and brand interactions (37% are following brands on social media).

Localized solutions in selling the idea of social commerce in mature markets need to be employed

At the heart of this is convenience – social commerce could allow for a seamless online shopping experience, one which is centered around the smartphone providing consumers with innovative, on-hand tools to find the products they want.

Chinese social platforms have led the way in convenience, letting users pay for bills or pay for items in-store or online.

And while China is obviously an exemplar, localized solutions in selling the idea of social commerce in mature markets need to be employed which don’t overstep their mark.

Localized solutions in selling the idea of social commerce in mature markets need to be employed Pinterest has invested significant resources in its visual search technology product Lens, and Instagram has tried to bridge the gap between visual brand discovery and purchase in its ‘Tap to View’ tags.

Both of these are great examples of platforms using their existing strengths to add real value to the shopping experience.

Building out this underlying framework and ensuring that social channels are part of an omnichannel strategy will prompt online shoppers to use social in a much more organic way.

And this point is paramount – social commerce must learn a lesson from online advertising.

Strong uptake of ad-blocking due to ad-weariness is a clear example of consumer backlash in the face of any marketing attempt that compromises their online experience.

If social commerce doesn’t make a serious impact this time around, it’s unlikely to get another chance.

Trend 3. Sports' online revolution

In a splintering media landscape, live sports have managed to retain their appointment viewing status.

But with the likes of ESPN, BT and Sky now reporting some declines for their sports broadcast audiences, it’s clear that even sports are no longer immune to the ‘cord-cutting’ phenomenon. How serious could this digital disruption be and how should the industry respond?

Social could pose the greatest challenge, as well as provide the greatest opportunity, for sports broadcasters and rights holders

With half of internet users watching TVOD each week, and a similar number watching services like Netflix, digital consumers have long become accustomed to consuming TV content whenever and wherever they please.

A similar transition is in motion for sports too; more and more people are turning to their laptops, mobiles and tablets to engage with sports content – catching highlights on-the-go via social media and augmenting their viewing through on-demand channels.

Our latest research shows that half of internet users are now watching sports coverage online each month, with mobiles a firm go-to for this behavior.

Twitter and Facebook already own the additional commentary that happens around sports

Arguably, it’s social that could pose the greatest challenge, as well as provide the greatest opportunity, for sports broadcasters and rights holders.

In April last year, Twitter announced it would stream National Football League games during the 2016 season. That was just the start; since then, we’ve seen a wealth of matches and tournaments streamed across social.

In Q1 2017, for instance, Twitter announced that it had delivered over 800 hours of live streaming premium content across more than 450 events, while Real Madrid generated more than 110 million video views on social after broadcasting live on Facebook.

Sports fandom has already progressed towards digital and social, and this will only continue.

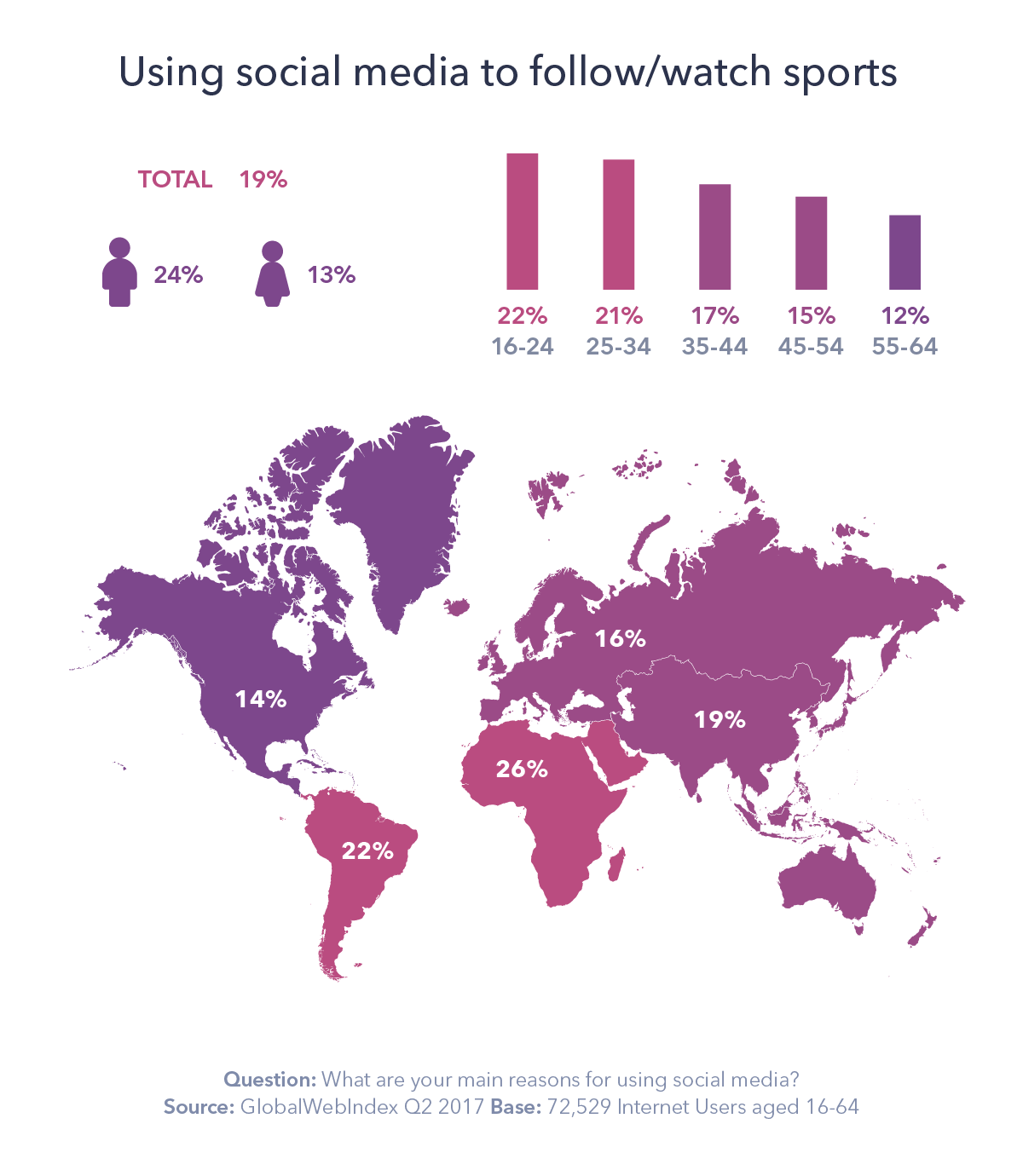

Globally, almost a fifth of internet users now follow sports events via social, while 14% of those on Twitter say they have recently tweeted about a sports event.

Twitter and Facebook already own the fan commentary around sports, and it’s easy to see how users could see appeal in watching more sports content on these platforms – especially as video takes over social and as mobile connections continually improve.

Rights holders and sports clubs need to deliver content to fans in the most convenient way, not the traditional way

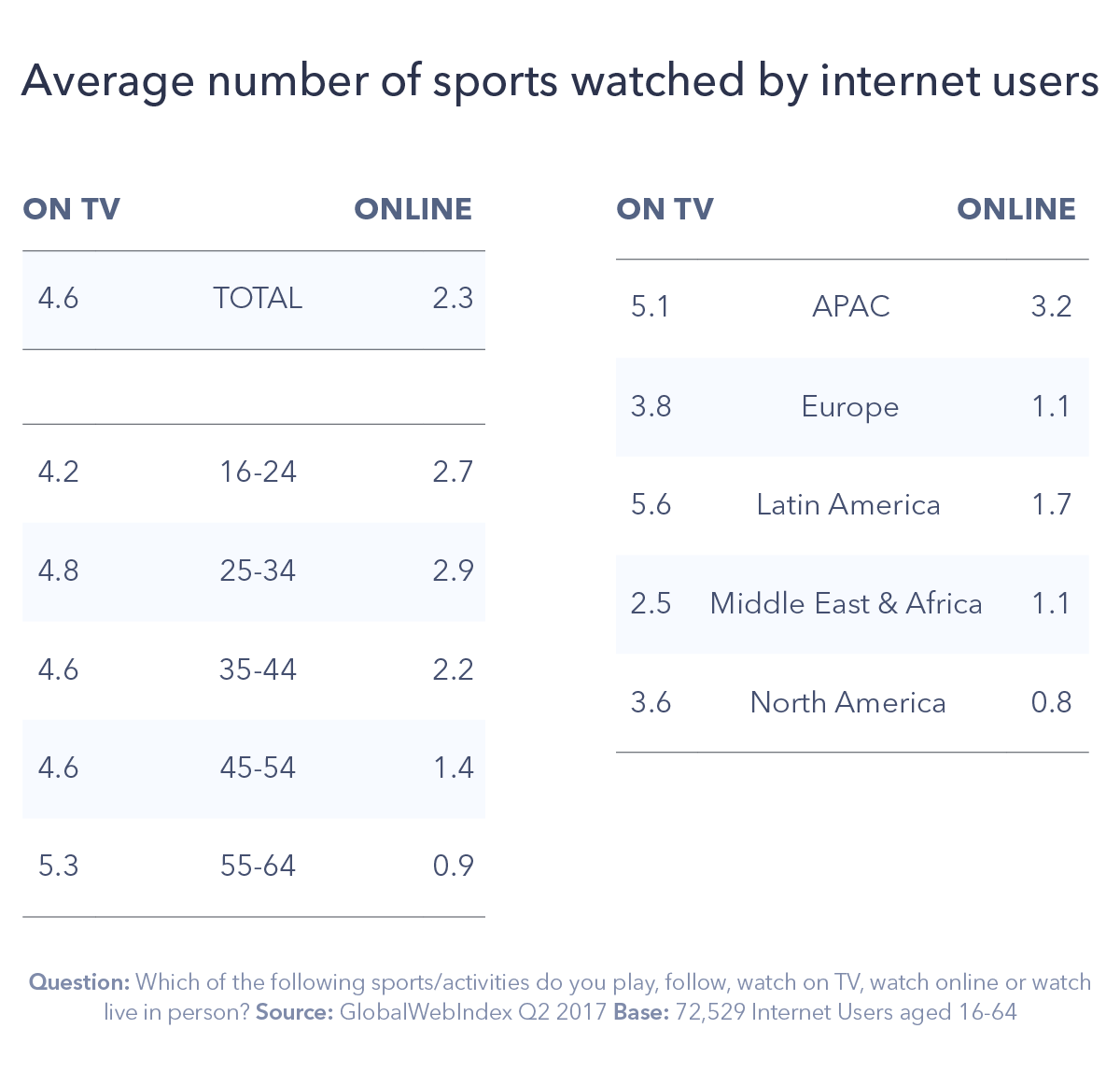

That’s not to say we’re writing off televised sports just yet. There’s still a clear preference for watching games live on a big screen and digital consumers continue to watch twice as many sports on TV as they do online.

But the online revolution is not one to be ignored; rights holders need to become less reliant on millions paying to watch live on their TV sets and instead deliver content to fans in the most convenient way possible – which, more often than not, means online.

Some have already taken a direct response to this. The Caribbean Premier League has decided to willingly cut up its broadcast rights into cheaper digital slices if that means reaching more people, and Manchester United has announced it will shift focus to its MUTV channel, citing the increased importance of direct revenues and audience data from OTT sports content.

While social media’s current role is to complement rather than replace traditional broadcasters, there are signs that things are changing.

Sports brands and broadcasters need to recognize that their audience now spans a multitude of devices and platforms. It’s in the industry’s own interests to take the initiative in establishing ways to fully engage this audience, or they will soon find themselves chasing the fans rather than leading them.

Trend 4. Digital marketing lessons from Africa

More than in any other world region, mobiles have played a central role in the development of internet behaviors in Africa.

This is borne out in the habits of its digital consumers; many online behaviors in Africa are distinctly different from those seen in other parts of the world, and the trends emerging in this region offer us a glimpse into how the coming era of mobile primacy could impact other markets.

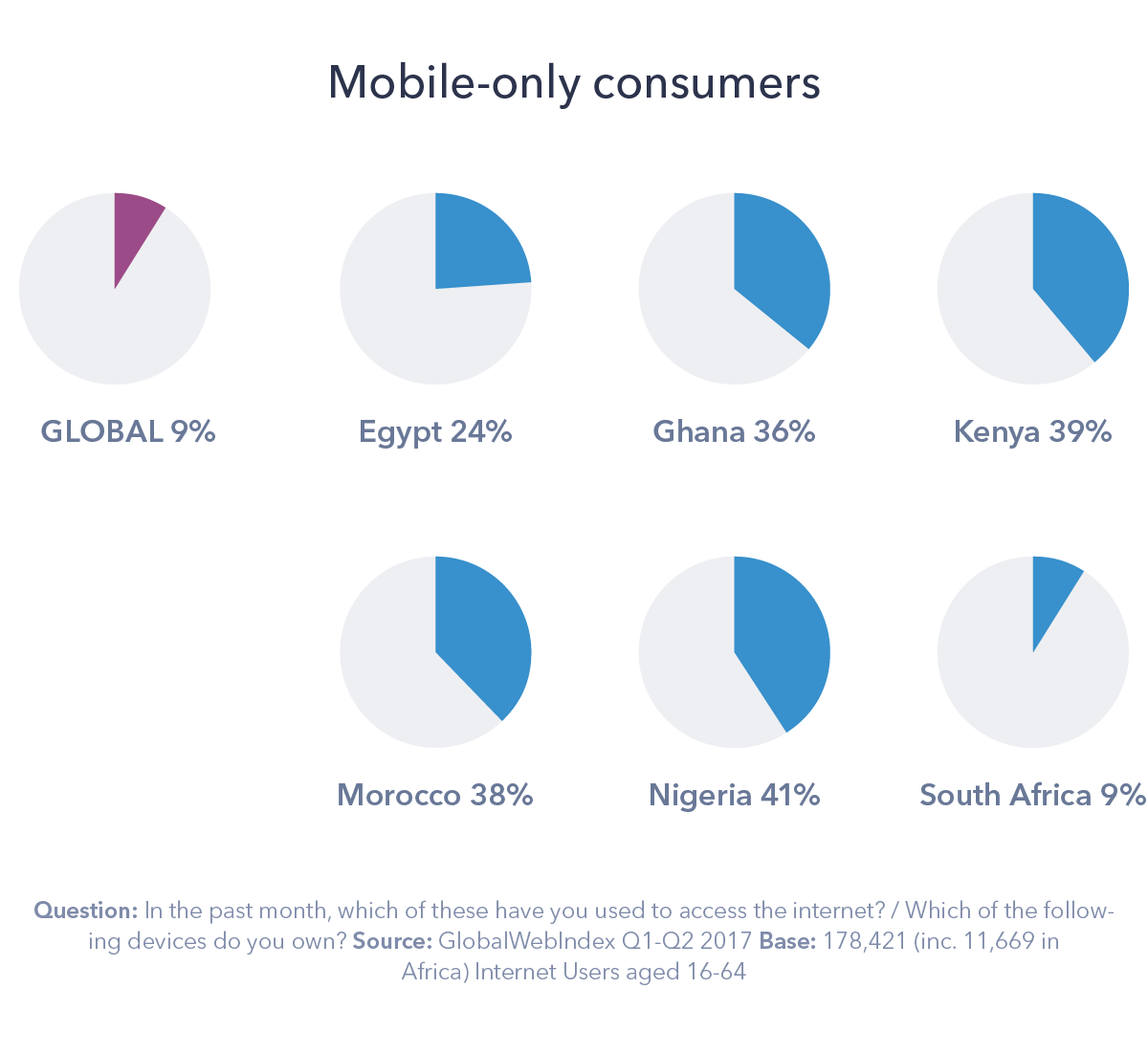

In countries like Kenya, Morocco and Nigeria, around 40% of digital consumers are mobile-only (not accessing or owning any other connected device). Compare that to only 9% of internet users across GlobalWebIndex’s 40 markets globally.

So, Africa presents a special test case for brands and marketers. In all other regions, widespread multi-device usage means that although a mobile-first strategy is certainly key, all devices need to be considered. In Africa, we can truly talk about mobile-only strategies that can be impactful.

This is a reality that we should expect to see in many markets in the coming years and there are key lessons to learn.

In Africa, we can truly talk about mobile-only strategies that can be impactful

Firstly, the dominance of mobiles has helped some African markets become world leaders for mobile money and payments solutions. While uptake of this functionality has been sluggish in many mature markets, in Kenya it’s over 40% who are paying for products/services via such services.

Mobile money is also allowing all mobile users (including feature phone users) to utilize mobile payments solutions, even if they don’t have a bank account or debit/credit card.

In many markets, mobile payments are often viewed as the preserve of the affluent, but Africa is demonstrating how these services can bring vast swaths of internet users, including those without sufficient access to financial services, into the realm of online commerce.

Africa’s social media users use fewer platforms, for longer and in a more active/engaged way

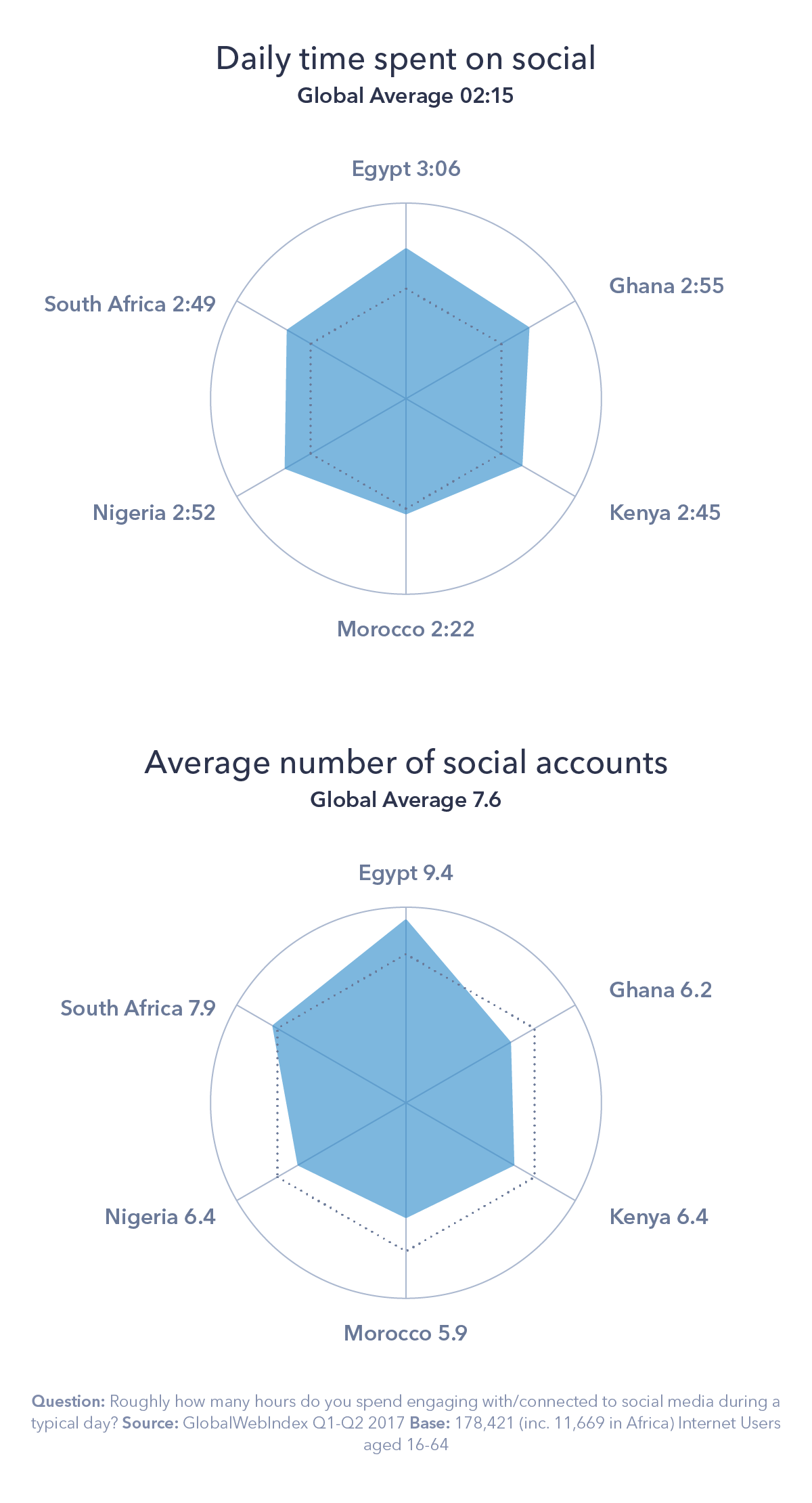

Equally important to note is that digital consumers in this region often display a different attitude to their social media portfolio than many other internet users around the world – using fewer platforms, for longer and in a more active/ engaged way.

Of particular importance is these consumers’ multi-networking behaviors; globally, internet users maintain about 8 social media accounts on average, but in somewhere like Morocco this figure is only about 6.

These consumers are focusing their social media activities on some core apps (Facebook and WhatsApp in this instance) while often neglecting other big names in the world of social.

So, we see that YouTube and Twitter post much lower figures in these markets than we usually see elsewhere.

Worldwide, we have seen the multi-networking trend peak in recent quarters. Africa could provide a picture of future social media habits, as consumers establish a set portfolio of social apps, leaving little room for new entrants into the social media industry.

Each year, millions of Africans are coming online for the first time and the region continues to rise in importance within the digital world. While digital consumers elsewhere have been much studied and obsessed over, the innovative and unique behaviors of internet users in Africa should be a lesson to all in how to navigate the mobile world.

Trend 5. Do smart consumers want smart homes?

By early 2018, Apple will have launched its HomePod device, a smart home speaker/assistant to rival the likes of Amazon Echo and Google Home. With Samsung, Sonos and others also set to enter this space, competition to become the default name in this area will be fierce.

The vast majority of digital consumers haven’t yet been convinced by the merits of smart home speakers

Launching initially in the US, UK and Australia, one of the biggest challenges for the HomePod (with its premium pricetag) will be to persuade consumers that it is an essential rather than a nice-to-have device.

Beyond the most committed Apple fans who will always buy any new release from the brand, the vast majority of digital consumers haven’t yet been convinced by the merits of smart home speakers. And that’s in the context of Amazon’s Echo having been available at a fairly modest price for some time now (including several promotional periods when it has been discounted aggressively).

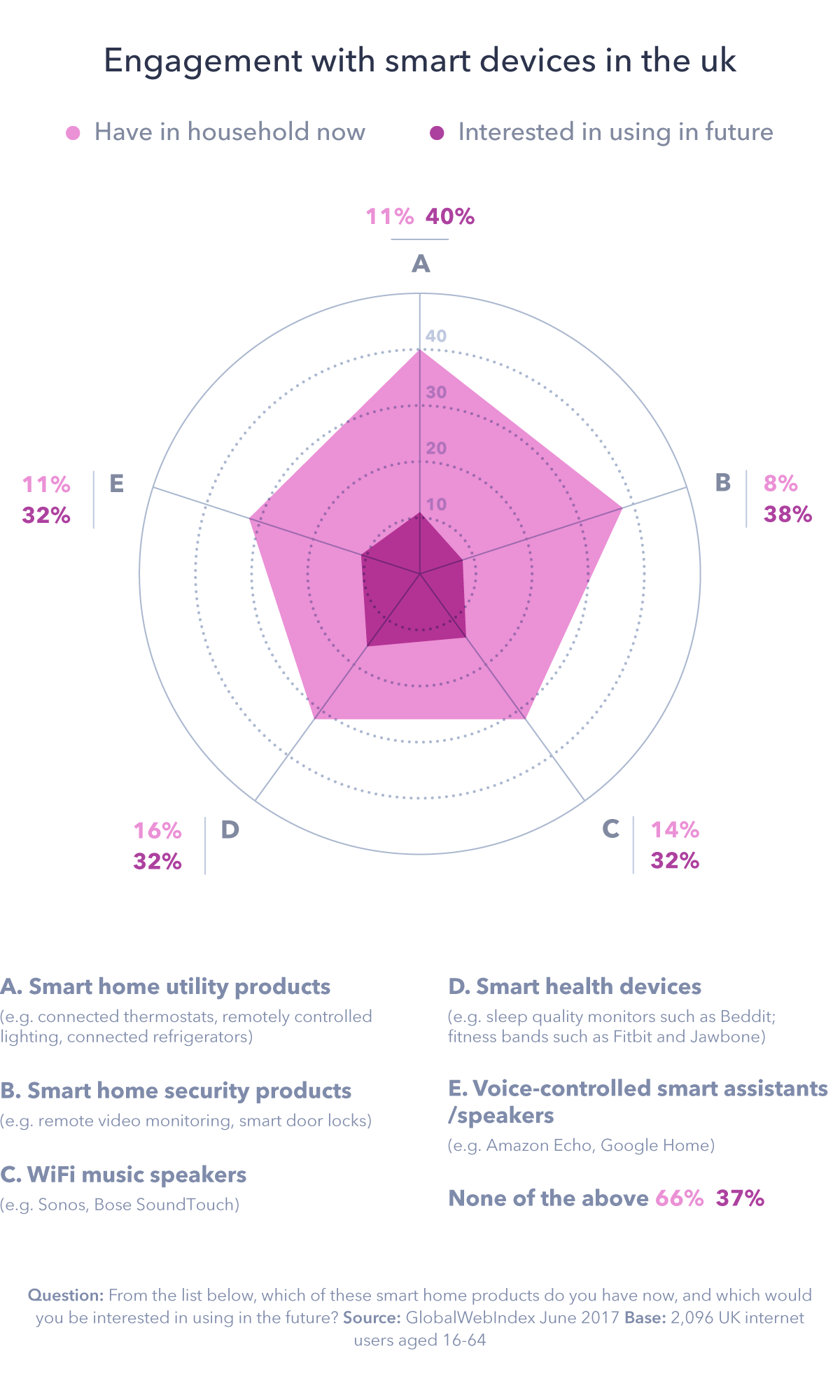

If we take the UK as an example, 2 in 3 digital consumers still don’t have any of the leading smart home products in their household, with most of the devices tracked in our chart scoring around 1 in 10 for usage.

Among current users, there are some predictable demographic trends: 25-34s, men and the upper income groups lead for all of them (except smart health devices, where women and 16-24s take the lead).

What’s arguably most revealing here is that over 1 in 3 say they aren’t even interested in using any of them in the future – something which underlines the scale of the value-communication challenge Smart home speakers might be able to carry out lots of functions but they don’t excel at any of them that the brands producing these products need to overcome.

Tellingly, smart home speakers come towards the bottom of the table for both usage and future interest.

Lack of awareness in some demographics is probably contributing to this, but so too is the perception in some quarters that smart home speakers don’t do any single thing particularly well (unlike the other devices tracked in our chart, all of which have a very clear raison d’être).

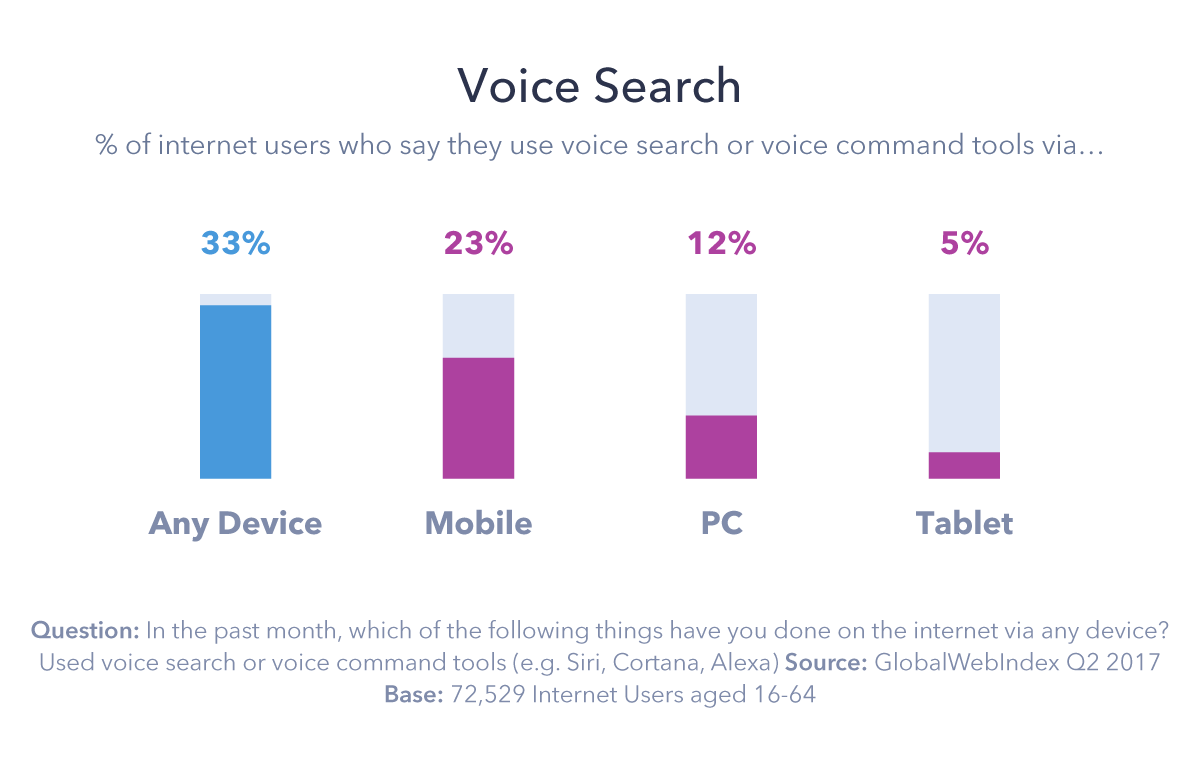

Put another way, smart home speakers might be capable of carrying out lots of functions but they don’t excel at any of them. Even for voice assistants like Siri, Cortana and Alexa – one area where smart speakers should be able to shine – GlobalWebIndex’s latest data shows that they face a huge challenge from mobile.

Currently, mobiles are already perceived to be the most important device in people’s day-to-day lives and, among the trend-setting youngest generation, they are capturing more time per day than all other devices put together.

Pretty much all mid-to-premium-end mobiles already have integrated voice assistants and, as their capabilities continue to become more sophisticated with each new generation of handset, smart speakers will need to demonstrate what value they bring that justifies an additional spend.

After all, smartphones also benefit from a regular replacement/upgrade cycle (which will be much longer for smart speakers) and are typically carried around with the consumer (unlike stationary smart home speakers which are located in one room).

In a sense, smart home speakers need to overcome some of the same obstacles that derailed smart glasses – a device with a premium price-point that struggled to demonstrate what it did better than a smartphone.

Fans of smart speakers might point to their potential as a hub device, connecting and overseeing other smart devices located throughout the home.

But these other devices will all be connectable and controllable through smartphone apps – and this is an area where the smartphone will score an automatic victory if the consumer wants to access them while away from the home.

Unless smart speakers start to prove their value and function, they could easily become the next tablet: a device which enjoyed fairly decent uptake but then started to gather dust as it struggled to compete with the endless advances and popularity of the smartphone.

Trend 6. The mobile payments race

It’s easy to think that the most inclusive and developed financial infrastructures will shape the future of mobile payments.

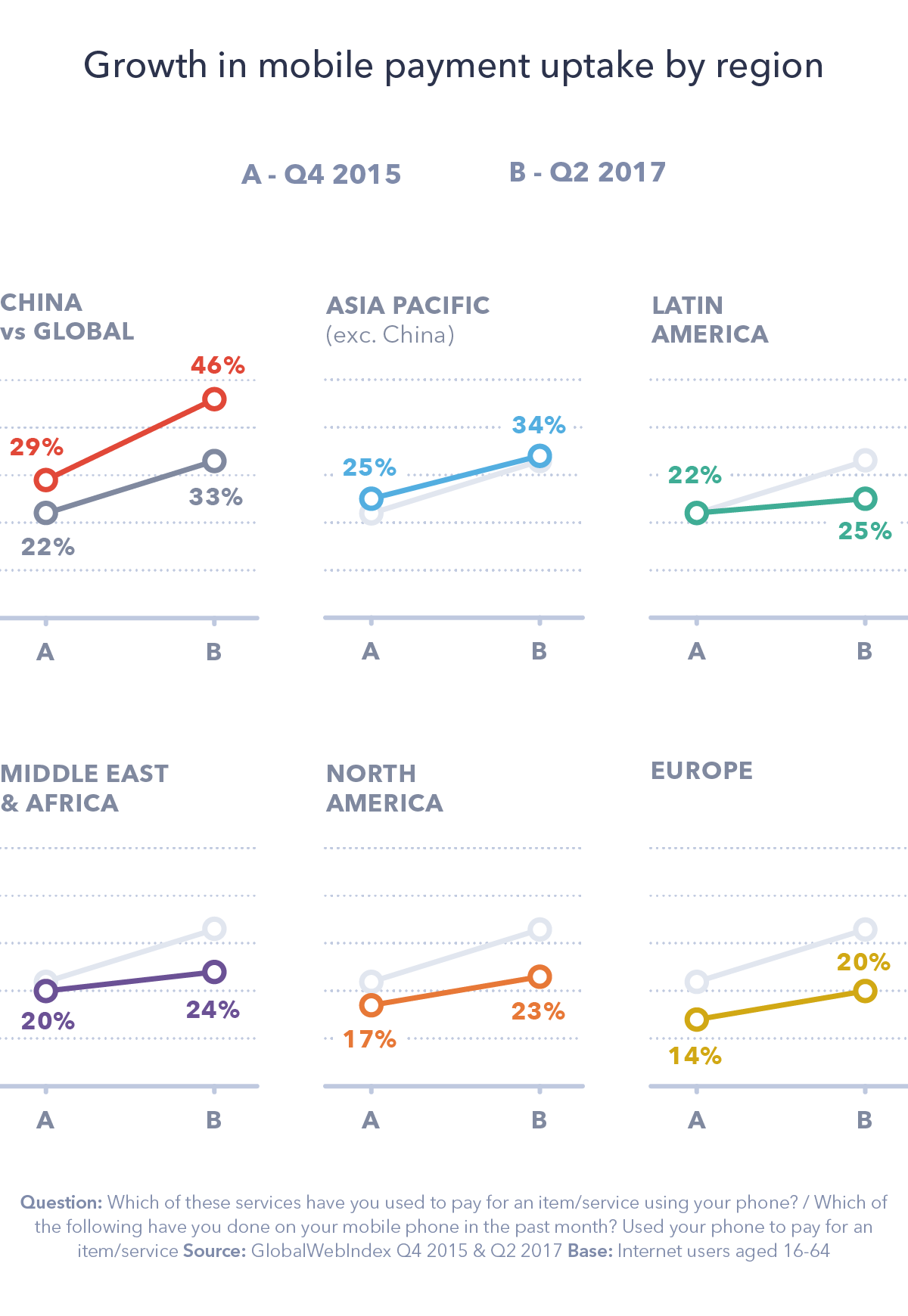

In actual fact, it’s in emerging markets where the potential of mobile payments is being realized, as rapidly expanding smartphone penetration rates help mobile payments leapfrog relatively undeveloped financial infrastructures.

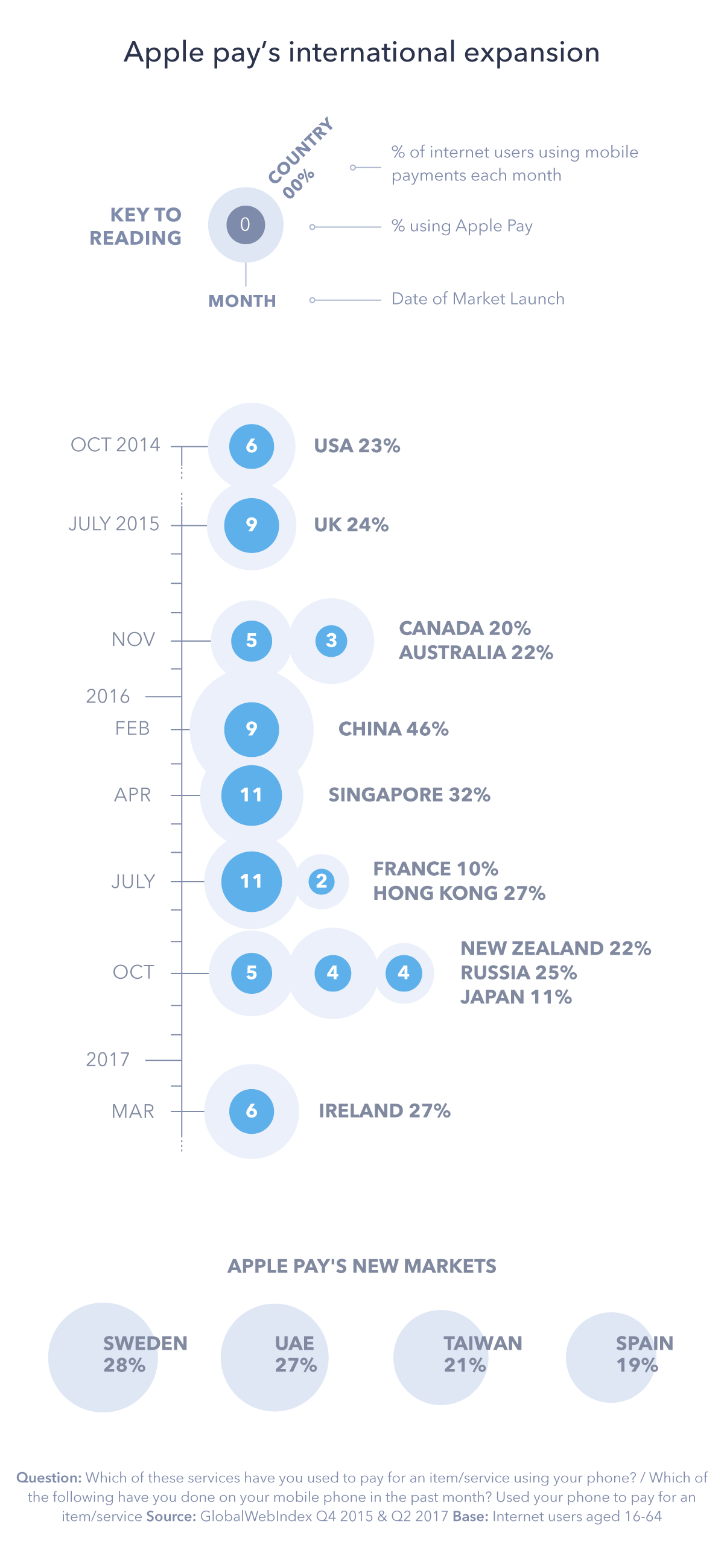

Two payment providers in particular – Alipay and Apple Pay – are eyeing up this window of opportunity to establish themselves in these markets, and both services have the financial backing and technical know-how to seriously shake up the industry.

Apple’s brand image is its major asset as it launches Apple Pay in more territories

The bulk of the global increase in mobile payment usage since late-2015 has come from APAC. Unique market conditions, a complex regulatory landscape and an absence of foreign competitors has up until now sheltered many of these markets from outside competition. This is beginning to change.

The industry heavyweights have now entered into a race to expand abroad and gain a foothold during this critical development period. India has emerged as the testing ground in this race following its extensive demonetization initiative, but other markets are also turning heads.

Apple Pay may operate in over 15 markets (at time of writing), but complex regulation makes international expansion a time-consuming and investment-heavy process.

To date, strong credit/debit card penetration in a country has also been key, while its handset-specific product – rather than the handset-agnostic approach of Alipay – has inevitably restricted the addressable market.

Even so, it’s Apple Pay which is emerging as a true heavyweight in its class with the strongest growth prospects, with the brand able to rely on a major asset: its brand image (a particular strength in many emerging markets).

Further international success will rely on this brand image and, with markets like India and Taiwan now in its sights, this pits Apple Pay directly against Ant Financial, owner of Alipay.

Countries leading the m-payments trend have unique market conditions with different stages of financial infrastructure development.

Rather than launching its own brand in these markets, Alipay invests in or acquires the established native players to leverage their existing market share.

This tactic has so far given Ant in-roads into India, South Korea, Philippines, Thailand and Indonesia, many of which don’t have the merchant-side capabilities at scale to support the Near Field Communication technology required for Apple Pay.

Alipay’s strength is in investing or acquiring local services to leverage their existing market share

But Alipay’s potential global reach becomes even more striking when we take into account Ant’s purchase of a majority share of SE Asian commerce site Lazada. With a broad reach in Vietnam, Malaysia and Singapore, Lazada should offer a strong use-case (likely in the form of financial incentives when using the app) to pay via Alipay on the site.

The company has already rebranded Lazada’s HelloPay as Alipay, giving it a much-needed brand recognition boost in these countries to build upon in the coming year.

As 2018 progresses, a handful of steadfast services will hold their own in their markets (like Naver Pay and Samsung Pay in South Korea, WeChat Pay in China, and Swish and Klarna in Sweden). However, there’s a good chance that we will see a large portion of the mobile payments landscape carved up between Apple Pay and Alipay.

Much of this division will be based around infrastructure development, with fast-growth markets most likely gravitating towards Alipay’s turnkey solution, and mature markets easing into the idea of contactless m-payments via a trusted brand like Apple Pay

Trend 7. The advent of social music

Across 2017, video established itself as the new driving force of social media innovation and engagement.

With both Facebook and Snapchat now investing in original TV content to be made available via their platforms, the commitment of the social media giants to stake a claim to a portion of TV revenues is clear.

So, what media will social services engulf in 2018? Well, a glance at the acquisition and hiring strategy of Facebook suggests that this social behemoth, at least, is beginning to take music seriously.

Facebook is now obliged to do business with music rights owners as users are uploading music videos to the platform

In July 2017, Facebook snapped up copyright identification startup Source3. Throughout the year it hunted for numerous senior positions relating to music licensing, after poaching Tamara Hrivnak, former director of music partnerships at YouTube, early in the year.

To a certain degree, Facebook has forced its own hand here – obliged to contend with music rights owners protesting that their content is freely available on the platform via user-uploaded music videos.

Of course, music has been an important part of social media since the days of Myspace, and in many ways the big social services are already part of the music business. Success in drawing artists and bands to create pages/profiles and interact with fans has made social media a key part of any music label’s strategy.

Social media’s previous attempts to capitalize on this relationship haven’t been all plain sailing, however – 2015’s ‘Music Stories’ feature on Facebook failed to gain widespread interest, while Twitter’s #Music service was shuttered in 2014. And, as many platforms have discovered, navigating the sea of contracts and agreements necessary to provide a rich music streaming library is not easy.

Social platforms will surely have noticed the engagement rates that streaming services have garnered

But in their ongoing quest to maintain engagement on their platforms, these social giants will surely have noticed the digital transformation that has impacted the music industry and the broad user bases that streaming services have gathered.

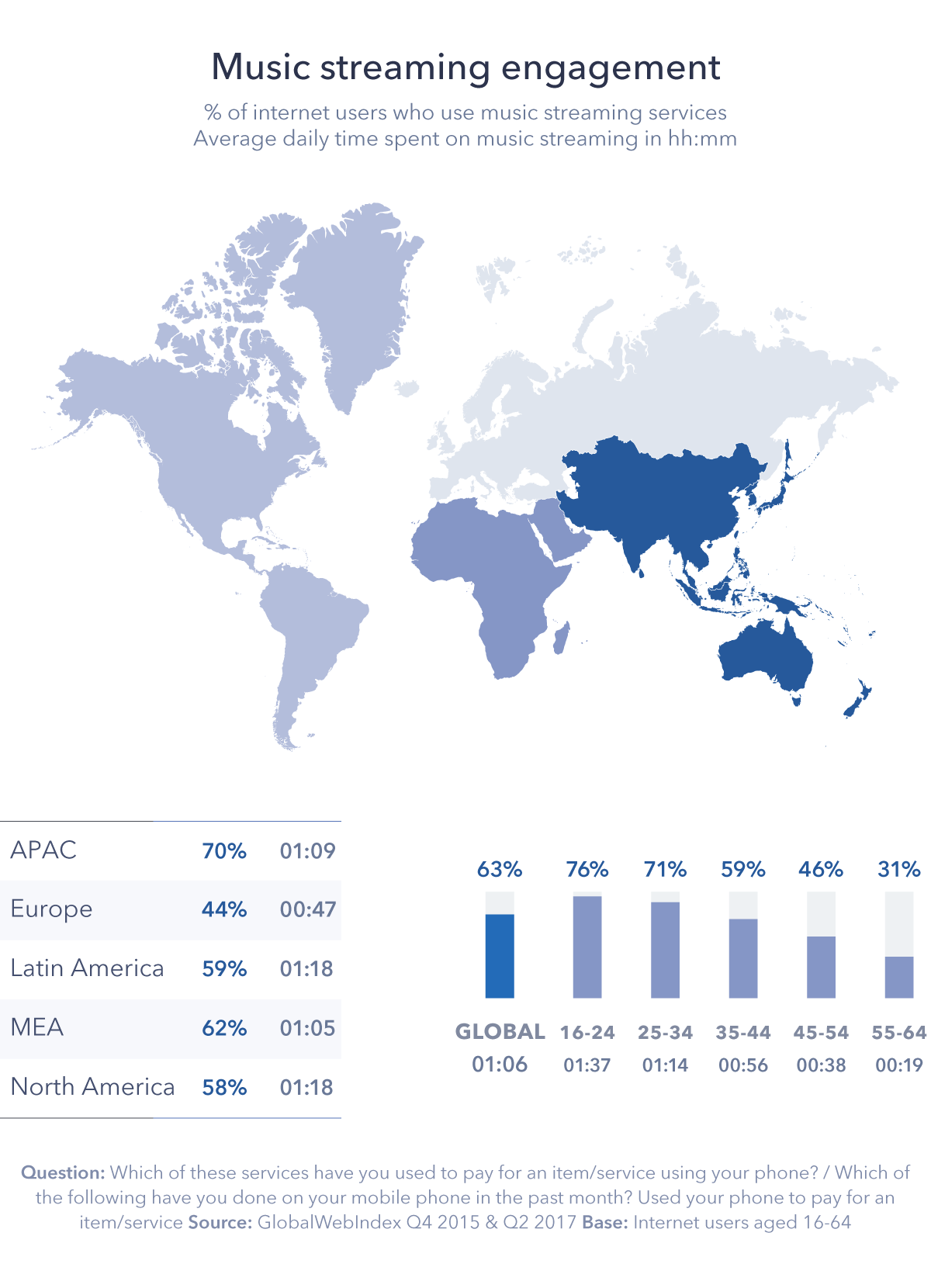

It’s now 63% of digital consumers globally who are listening to music streaming services and with internet users now more likely to say that they prefer to stream music online, rather than own it themselves, the figures will only grow.

What’s more, adding another revenue stream will be attractive to the big names in social media, particularly given their enthusiasm for diversifying into the worlds of video and commerce.

Exactly how they achieve this will certainly be interesting to watch. So far, most consumers have been quite reticent about paying for access to music, and for purchasing content directly via social media.

Social platforms’ traditional revenue models – providing services/content in exchange for data and advertising exposure – is one with which music labels are becoming increasingly frustrated.

Apple Music and Tidal have touted the ‘premium-only’ model as the future of music streaming, while Spotify has felt the heat for steadfastly defending its ad-supported offering. Yet the social media industry’s laser-focus on user growth and engagement means that it will surely push for freely accessible music for its users.

However it comes about, the advent of social music is upon us. As in the realm of TV, there will be much speculation about what strategy the big social platforms, particularly Facebook, employ to breach into this industry. But regardless of the details, it looks like music will be the next media to go social.

Trend 8. Is the influencer marketing boom sustainable?

Influencer marketing has become the industry’s hot go-to strategy – just take a look at the host of celebrities on your social media feeds encouraging you to visit this hotel and try that beauty product.

Many brands have invested heavily, attracted by the opportunity to amplify their content and organically build new relationships.

But is this buzzworthy trend all that it’s cracked up to be and, importantly, is it set to be a sustainable strategy for brands?

In the new world of ad-blocking, influencer marketing was bound to be alluring

Influencer marketing was bound to be alluring to marketers. With the ongoing challenges of ad-blocking and banner fatigue, digital ads are no longer as appealing as they once were and marketers are turning to alternative strategies.

Immune to ad-blocking, influencer marketing makes sense here, especially because consumers are already receptive to recommendations when they’re shopping.

According to our research, over half of internet users say they tend to seek an expert opinion before buying something, and it’s logical that they would look to their influencers for this advice, just as they would their friends and family.

Of course, this strategy is not new, and it’s already proved to be a success for some brands. Back in 2015, department store Lord & Taylor collaborated with 50 Instagrammers, asking them to Instagram themselves wearing a specific dress on a specific day, causing the dress to quickly sell out on its website.

Then there’s L’Oréal, which shifted its investment from traditional media to influencers, reportedly seeing a positive impact on sales thanks to the influence of its ‘Beauty Squad’.

But influencer marketing may not be as fool-proof as it sounds. As more and more brands jump on the bandwagon there comes the threat of influencer fatigue.

Between the high-profile celebrities paid to hold handbags, and the lesser-known micro-influencers sent free products to review, promotional content is beginning to clutter up news feeds.

And as this space becomes more saturated, there’s a good chance that audiences will become disengaged. Just as they turned to ad-blockers when sites became overloaded with ads, there’s the chance that they’ll turn away from influencers in the same way.

As the space becomes more saturated audiences could become disengaged

There’s also little sign in our data that this is becoming a major route to reach consumers.

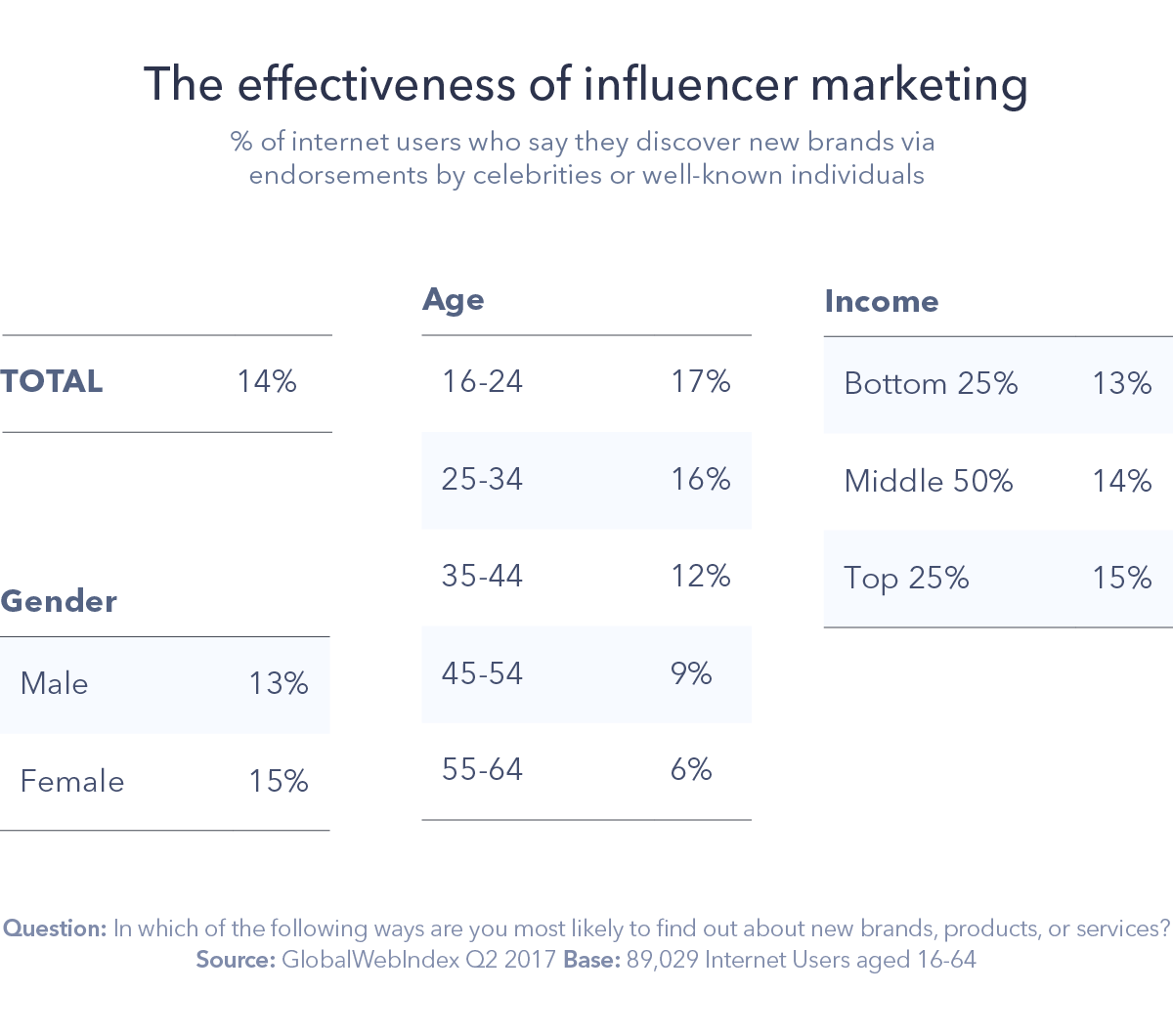

While it could be argued that it’s harder for consumers to recognize when they’ve been influenced by or exposed to an influencer (as opposed to a TV or print ad), it’s nevertheless just 14% of digital consumers who say they discover brands via celebrity or influencer endorsements.

This is a figure that has remained remarkably steady over the past couple of years, despite the influx of influencer posts. We do see a slight peak to 17% for 16-24 year-olds, but even here its impact is limited when compared to other strategies, like traditional advertising.

Digital consumers are about 3 times as likely to say they discover brands via TV or online ads, for instance.

With the supply of influencers at an all-time high, it’s starting to lose its personal touch. The backlash against influencers who aren’t authentic is sure to follow, and brands need to be prepared. They need to be smart, focusing on sincerity and building a long-term relationship only with those who fit with their messaging.

Some consumers will walk away from the influencers who have clearly been bought by brands, where there is no story behind promotional content, or when they are just doing one-offs.

Brands need to focus on sincerity and relationship-building that matches their message

Part of the reason for L’Oréal’s successes is because it partners with micro-influencers rather than high-profile celebrities.

And by allowing these women to critique the products they weren’t happy with, the content appears authentic and believable. An overloaded use of influencers is not a sustainable strategy and it’s only a matter of time until the influencer bubble finally bursts.